Uncertainty persists in the M&A world

2020 has been anything but predictable.

The construction materials industry began the year with as much optimism as we’ve seen in nearly a decade, only to see that optimism quickly replaced with uncertainty at the onset of the COVID-19 pandemic.

To further heighten tensions, the construction materials space’s near-term outlook will be drastically impacted by the presidential election, federal and state infrastructure budgets, and rapidly changing fiscal and monetary policies. All of these events compounded to create a cloud of uncertainty for the industry not seen since the Great Recession.

This environment has meaningfully altered the outlook for mergers and acquisitions. Since 2014, the construction materials M&A market has been robust, with acquirers actively pursuing transactions and bidding up transaction multiples. Since the onset of the pandemic, however, capital spending across the industry has declined, and buyers are becoming increasingly selective about where to deploy capital in a time of unprecedented economic change.

With the onset of the pandemic, buyers initially pulled back as they watched stock prices drop along with growing concerns about whether the sector would be deemed essential. Among the many buyer concerns by midsummer were Department of Transportation budgets, federal funding and the impact of projects for the second half of the year and into 2021. Still, things have stabilized, bringing buyers back to at least “take a look.”

What to watch

There are three primary developments FMI Capital Advisors is monitoring closely as the economy enters the fourth quarter. Each will have a meaningful impact on the 2021 market for the construction materials operating year and the M&A market.

1. The duration of the pandemic and its impact on state and federal budgets. While the pandemic has had a dramatic effect on the overall economy in general, the effect of the virus on government finances is a major issue for the construction materials industry.

According to officials at the American Road & Transportation Builders Association and the American Association of State Highway & Transportation, states across the U.S. have delayed or canceled more than $8 billion in surface transportation projects – and they are in need of more than $37 billion through 2024 to offset revenue losses.

While many construction materials firms have continued to perform well this year due to a combination of existing backlogs and a relatively strong housing market, the uncertainty surrounding infrastructure funding adds difficulty in forecasting growth in 2021 and beyond. This also complicates pricing for M&A transactions.

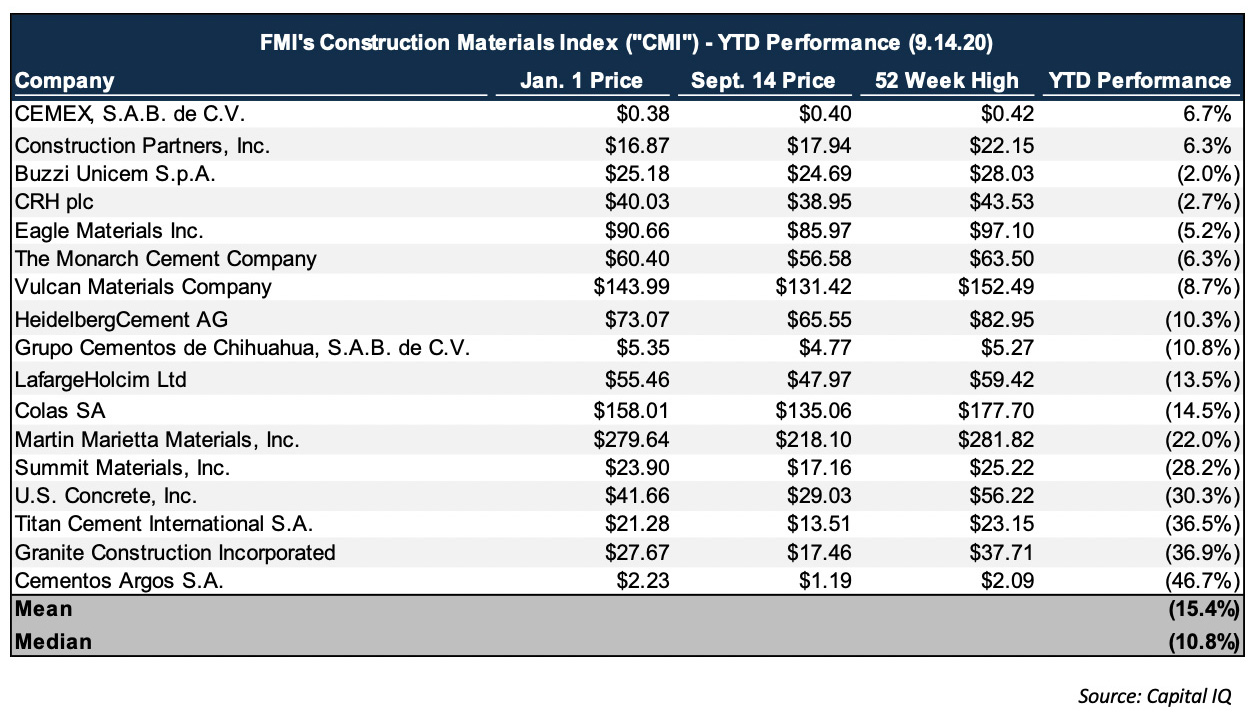

Through Sept. 14, 2020, the public firms within FMI Capital Advisors’ Construction Materials

Index (CMI) are down about 15 percent in 2020. Click to enlarge | Chart: Flashworks/IStock / Getty Images Plus/Getty Images

2. The effect of monetary policy on the stock market and broader inflation outlook. Despite a shift in market expectations for 2020 and 2021, public company stock prices remain strong. The public firms within FMI’s Construction Materials Index are down only 15.4 percent year to date, despite the greatest economic contraction since 1947 – and possibly the Great Depression.

Meanwhile, at press time, the S&P 500 is up 3.9 percent on the year and the Dow Jones Industrial Average is down 3 percent. This relative stability in stock prices was largely driven by the exceptional expansion of monetary policy underway at the Federal Reserve.

Since March, the Federal Reserve’s balance sheet has grown by more than $3 trillion to shore up the economic effects of COVID-19. Additionally, the Federal Reserve enacted unprecedented monetary actions, such as purchases of corporate bonds and municipal securities, and issuances of loans to medium-sized businesses across the country.

In sum, the Fed more than doubled its monetary expansion since the Great Recession. This has become an increasingly important factor in the outlook for economic growth.

Looking ahead to 2021, the Federal Reserve’s policies will continue to be a focus of investors and will also affect stock prices. Assuming low levels of inflation persist, expect the Federal Reserve to continue its expansionary monetary policies, which should result in an increase in the availability of debt financing (particularly for public companies), buoy stock prices of publicly traded construction materials firms, and generally support overall economic growth.

Still, if inflation should jump meaningfully, the party could end very quickly and have a meaningful effect on overall industry performance.

3. The effect of the 2020 election on federal policy. The outcome of the 2020 election only adds to the extraordinary uncertainty that the COVID-19 environment presents. The presidential election alone is likely to affect tax rates, infrastructure funding, environmental policy, health care policy and other key policies that affect the business economics of construction materials producers.

The divergence in policy positions between a Trump administration and a Biden administration once again creates a challenging forecasting environment. Potential corporate tax hikes could drive projected cash flows downward, affecting both volume and pricing for the M&A environment. At the same time, increased funding could lead to a top-line improvement for the sector.

A cautious outlook for 2021

The public firms within FMI’s Construction Materials Index (CMI) are down only 15.4 percent year to date despite the greatest economic contraction since 1947 and possibly the Great Depression. Click to enlarge | Chart: FMI

2020 has been a remarkably unpredictable year. While this uncertainty is likely to persist into 2021, the market for M&A is likely to rebound as election results are finalized, the pandemic ebbs, and businesses and the broader economy return to some semblance of normalcy. The timing of these factors remains a key question, though.

In the interim, we expect transactions that are closed will be driven first by buyer synergies. For example, transactions that drive exemplary cost savings or market share consolidation will be favored, as well as those in markets with stronger growth profiles coming out of the pandemic. States with strong infrastructure packages – that remain funded – will likely be on the top of this list.

Ultimately, while uncertainty is likely to persist in the coming months, there remains a pent-up supply of sellers driven by both demographics and overall succession challenges. Additionally, the publicly traded buyers will face pressures for additional growth, leading to good supply-and-demand dynamics for deals.

As we push through the fourth quarter, all eyes are looking toward 2021. With so many unknowns, it remains a challenge to determine if and when the markets will fully recover. Accustomed to annual market updates, we find ourselves revisiting market outlooks on a much more frequent basis.

The two big ifs for 2021 are whether COVID-19 diminishes and the outlook for funding. We hope to have improved visibility on these issues by the end of the year.

George Reddin and Scott Duncan are managing directors with FMI Capital Advisors Inc., FMI Corp.’s investment banking subsidiary. They specialize in mergers and acquisitions and financial advisory services.

Featured image: P&Q Staff