SC Market Analytics adjusts aggregate forecast

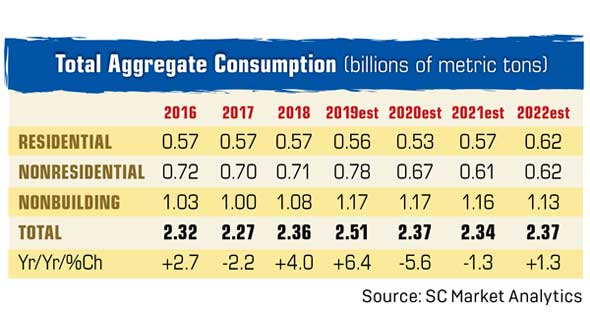

SC Market Analytics estimates aggregate consumption to be down 5.6 percent this year, although consumption tied to nonbuilding projects is expected to be flat compared to 2019. Click to expand | Chart: SC Market Analytics

The U.S. economy tanked after being hit with a shutdown.

GDP was down 32 percent in the second quarter compared to the prior year’s quarter. The record decline helped to flatten the curve, but it did not stop the spread of the coronavirus.

Now, the economy is opening using safe practices and knowing that the mortality rate of the coronavirus is well under 1 percent – versus a prior guess of 5 percent. So, our assumption is that the virus will be managed by the end of 2020 – a few months earlier than our prior assumption.

Effective treatments and a vaccine by the end of 2020 seem to be the most likely path to eradicate the virus, but they’re not a guarantee. Because of our assumption and more than $3 trillion in rescue stimulus, we believe the V-shaped recovery is still on track. The recovery path beyond 2020 assumes no significant growth-killing policies.

The impact on aggregate

These conditions resulted in SC Market Analytics increasing near-term aggregate growth. Both 2021 and 2022 are now higher, largely due to a sharper spike in new home construction. Record-low mortgage rates, a growing economy and pent-up demand will result in 2022 achieving the highest residential aggregate demand since 2007.

Nonresidential will unfortunately not benefit from these trends, as the Amazon effect and structural changes brought on by the virus will push demand to levels near the 2010 to 2012 lows.

Nonbuilding will recover, but not by much. We assume the next round of stimulus will not include significantly higher infrastructure spending, as other priorities squeeze out most of the new funds. This means nonbuilding aggregate consumption will remain at high levels, with only modest gains over the next three years.

Regionally, the states will vary greatly over the next three years. The virus and economic changes are impacting per capita consumption for select states. States that are crowded and implemented the most severe shutdowns will recover slowly (i.e., California, New York). Lower-density, less-drastic shutdown states, meanwhile, will be the least impacted (i.e., Tennessee). Florida is mixed, as it is an example of a high-density, rapid-growth state with a large, vulnerable cohort of elderly residents.

David Chereb, Ph.D., is with SC Market Analytics (SC-MA), which produces customized market forecasts by major segment of construction, from the county level up. Clients use SC-MA market intelligence reports for business planning and acquisition analyses in aggregate, ready-mixed concrete and cement.

Featured Photo: Art Wager/iStock / Getty Images Plus/Getty Images