Economic factors to consider in the new year, decade

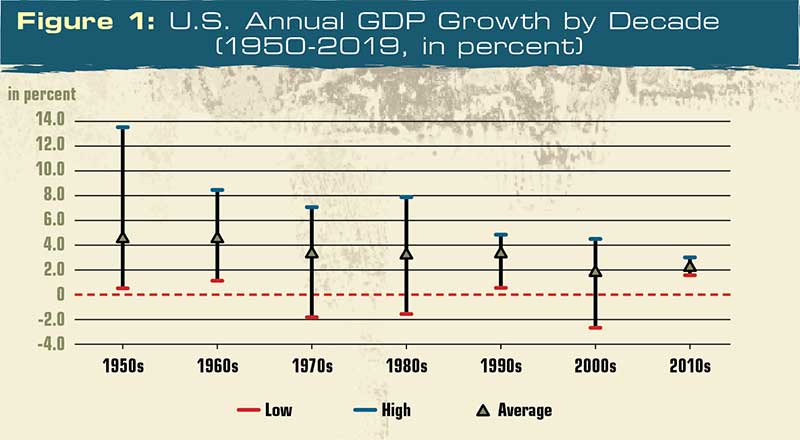

Although the 2010s likely represent the first decade in U.S. history without a recession, the nation’s annual GDP growth over the last decade was rather low from a historical point of view. Click to enlarge. Source: FRED

With 2020 underway, the United States is on the brink of economic history: should third-quarter 2019 GDP remain positive following final revisions, the 2010s will end as the first in American history without an economic recession.

Over the nation’s 244-year history, economic recessions have occurred on average every five years, with several decades (i.e., the 1910s and 1920s) experiencing three. The 10-year period from 2010 to 2019 will be the longest period of consistent economic growth in American history.

While unusual in its duration, this expansion has not been exceptionally robust. Since 2010, the United States has averaged 2.3 percent annual growth in GDP, without a single year exceeding 3.0 percent. From 1950 to 2009, annual GDP growth averaged 3.4 percent and even exceeded 4.0 percent annual growth in 29 of those years.

In other words, slow growth has replaced volatile, but robust, economic expansion.

Opposing opinions

In construction materials markets, this environment is driving a contradiction. In public forums, industry leaders are expressing strong confidence in 2020 and, in many cases, projecting mid-single-digit growth in production and pricing.

This optimism, however, is contrasted with an increasing level of conservatism and discipline on capital allocation. Construction materials mergers and acquisitions (M&A) in 2019 were dominated by smaller bolt-on transactions and a dearth of larger transactions.

For example, in 2017 there were six construction materials M&As valued over $250 million, three in 2018, and just one in 2019: Eagle’s recently announced acquisition of Cemex’s Kosmos cement plant and related assets in Kentucky.

An uncertain environment makes capital allocation more challenging. After a decade of growth, many of the largest U.S. public construction materials firms have ample capital available for investment, but they are increasingly cautious of deploying it through M&A.

As a result, firms are spending capital primarily on lower risk organic opportunities, including greenfields, quarry/plant expansions and replacements, and equipment upgrades.

2020 vision

In short, the market for construction materials M&A in 2020 will be complex. Sellers will need a very clear view of how their firm fits in the broader market of opportunities. They also must clearly articulate market position, synergy opportunities and growth prospects to prospective buyers to complete a successful transaction.

Our view is that the 2020 market for construction materials M&A will be active, but that the market will be driven by the following key factors:

1. State-funded infrastructure growth opportunities. Since 2012, 38 states have passed legislation raising additional revenue to fund transportation projects. In the first seven months of 2019, more than 300 pieces of legislation across the U.S. were introduced in state legislatures to fund transportation investments.

State infrastructure funding is quickly becoming one of the key macro-growth drivers for the construction market, particularly as housing, industrial and commercial construction spending all continue to grow at relatively anemic rates. Companies operating in states with large infrastructure investment dollars will likely see more interest from prospective buyers.

Smaller bolt-on transactions and a dearth of larger transactions dominated industry M&A in 2019. Photo: P&Q Staff

2. Strong market positioning and synergy opportunities. As buyers become more circumspect in their allocation of acquisition capital, target companies with top one or two market positions in regions with high barriers to entry and limited competition are more attractive. These target companies typically present a more attractive risk profile to investors and, to the extent synergies can be extracted from the transaction, represent the best opportunities for buyers in a 2020 market.

As a result, bolt-on transactions will continue to be more attractive than platform deals in the coming year.

3. Logistical advantages and local reserves. Many urban markets across the country are rapidly depleting local aggregate reserve bases and are increasingly served by imported products. As a result, companies with either aggregate reserves close to urban population centers and/or the ability to distribute aggregate at a delivered cost advantage compared to competitors will be in high demand.

4. Private equity influence will increase. As strategic buyers become wary of a recession and more cautious with capital investments, the influence of private equity in the construction materials market will increase. Private equity firms are reaching record levels of dry powder, having raised more capital in 2019 than in any prior year. For these buyers, the materials market presents a unique opportunity to deploy capital in a market with ample investment exit opportunity.

Final thoughts

In sum, 2020 is likely to be a volatile year. Impeachment, continued trade disagreements, recession concerns and a presidential election will all serve to make investors more cautious as they approach the M&A market.

Still, as the overall economy continues to grow at modest rates, buyers will be looking for meaningful growth opportunities – it will just be a question of where they can find it.

George Reddin and Scott Duncan are managing directors with FMI Capital Advisors Inc., FMI Corp.’s investment banking subsidiary. They specialize in mergers and acquisitions and financial advisory services.