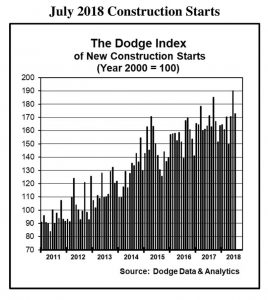

Construction starts fall back in July 2018

Chart courtesy of Dodge Data & Analytics

At a seasonally adjusted annual rate of $817.4 billion, new construction starts in July fell 9 percent compared with the June reading, reports Dodge Data & Analytics. The July statistics also produced a reading of 173 for the Dodge Index (2000=100), down from the 190 for June, which was the highest level so far during 2018.

According to Dodge Data & Analytics, July’s decline followed strong gains for total construction starts in May, up 14 percent, and June, up 11 percent.

In July, nonresidential building fell 22 percent after rising 59 percent in June. While July did see several large manufacturing and office projects reach groundbreaking, it did not see as many as in June. In addition, residential building in July was up 2 percent and nonbuilding construction remained unchanged.

“The pattern of construction starts on a monthly basis is often affected by the presence or absence of very large projects, and several exceptionally large projects boosted activity in June to an unsustainably high amount,” says Robert Murray, chief economist for Dodge Data & Analytics. “These June projects included a $6.5 billion uranium processing plant in Tennessee and a $1.7 billion petrochemical plant in Texas, as well as the $1.8 billion Spiral office tower in New York and a $665 million office tower in Chicago. While July also featured the start of several large projects, such as a $2.4 billion petrochemical plant in Texas and a $750 million data center in Alabama, the lift from very large projects in July was less than what took place in June. Still, the pace of construction starts in July came in 2 percent above the average for the second quarter, which is consistent with the sense that overall construction starts continue to trend upward, notwithstanding July’s steep decline compared to June.”

During the first seven months of 2018, total construction starts on an unadjusted basis were $471.4 billion, up 2 percent from the same time period one year ago. If the electric utility/gas plant category is excluded, total construction starts during the January through July 2018 period would be up 5 percent compared with the same time period last year, Dodge Data & Analytics adds.

For the first six months of 2018, the Dodge Index averaged 165 during the first quarter and 170 during the second quarter. According to Dodge Data & Analytics, July’s reading of 173 shows at least the initial month of the third quarter is continuing the gradual upward trend shown by the first two quarters of this year.

“The current year has seen the mounting headwinds of higher material prices and higher interest rates, but it’s also seen the tailwinds of healthy economic growth, some easing of bank lending standards and the increased funding for public works programs coming from the federal appropriations legislation passed in March,” Murray says. “Amidst the monthly ups and downs, the broad trend for construction starts during 2018 remains one of modest expansion.”