Chereb: Growth ahead for economy, aggregate industry

Chereb

Masks be gone.

People should look normal again by summer – at least outside. Moods are improving every month, and a burst of consumer spending is coming with it. Government finances at the state and local levels are improving quickly. Combined with higher federal spending, the stage is set for much higher infrastructure spending – even if it isn’t as high as advertised.

So far, the trillions of dollars that are entering the economy have helped stocks, housing and now cryptocurrencies. Little has gotten into hands of the average American, even with $1,400 stimulus payments. If an infrastructure bill passes and a few hundred billion dollars are allocated to roads and bridges, that’s gravy added to an aggregate industry recovery that’s already underway.

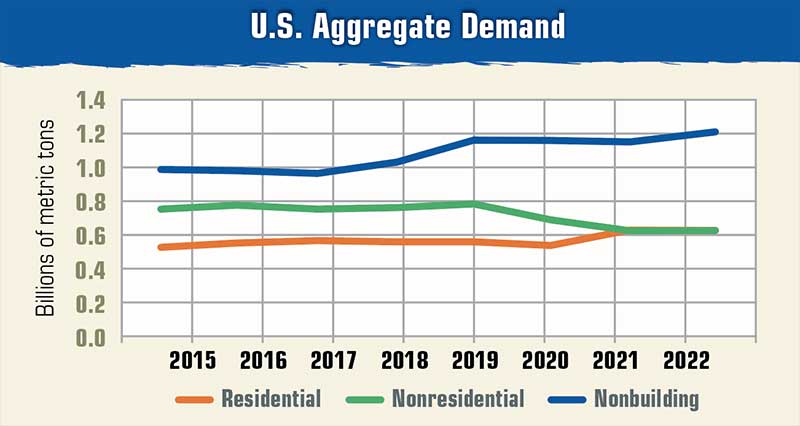

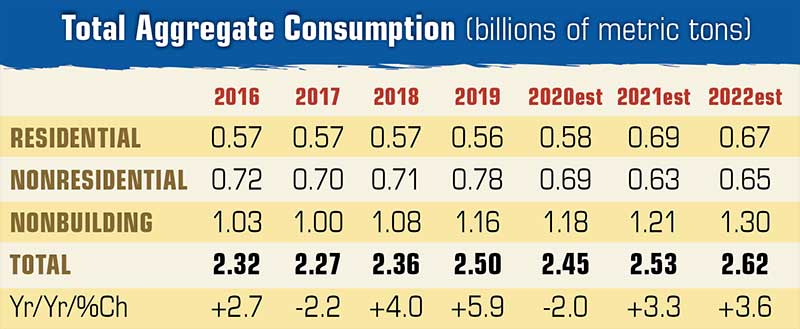

Housing is still red hot, and nonresidential is near the bottom. This means at least two more good years of aggregate growth are ahead.

Click to enlarge. Source: David Chereb Group

Segment by segment

By segment, nonbuilding construction will improve the most. More money from all levels of government is already in the works for this segment.

Nonresidential construction is the most interesting segment. The Amazon effect of online shopping is not yet complete and continues to reduce mall traffic. The decline of the pandemic, however, means some near-term demand pull will be at work this year and in 2022.

Click to enlarge. Source: David Chereb Group

What will be interesting is how developers dream up new ways to attract shoppers and new office protocols to bring people back from working at home. Technology made centralized offices less necessary, but not unnecessary. There is still synergy from people working near each other.

Housing, meanwhile, is hot (although we all know this by now). The hot housing market will continue for most of this year. Sometime this year, we expect interest rates to rise and result in fewer people qualifying for new mortgages. Extremely high home prices and higher mortgage rates will result in a housing plateau next year, with declines after that.

Regionally, not much has changed. The Sun Belt, energy states and Mountain West will all do well. If removing state and local tax deduction limitations isn’t changed, migration from high-tax states will continue at a rapid pace.

Aggregate pricing strength will return by mid-2021 in most areas and do even better in 2022.

David Chereb Group, Ph.D., is with David Chereb Group (DCG), which produces customized market forecasts by major segment of construction, from the county level up. Clients use DCG market intelligence reports for business planning and acquisition analyses in aggregate, ready-mixed concrete and cement. Visit davidcherebgroup.com for more information.

Featured photo: kozmoat98/iStock / Getty Images Plus/Getty Images