Aggregate producers still going strong

Through P&Q’s annual State of the Industry Report survey, the collective picture that came together about 2018 is a highly positive one. Photo by Kevin Yanik

Characterizing the state of the aggregate industry in a way that satisfies everyone is no simple task.

Just as no two aggregate operations are the same, the market conditions in Maine are vastly different from those in Southern California. Like a puzzle, though, pieces can be assembled to provide a snapshot of how the industry at large is doing.

Through regular conversations with producers, equipment manufacturers and industry stakeholders, as well as data Pit & Quarry collected through its annual State of the Industry Report survey, the collective picture that came together about 2018 is a highly positive one.

Aggregate sales were up for the majority of producers along with pricing, and the industry will carry the optimism it brought into 2018 into 2019. A multi-year federal infrastructure bill did not come to fruition this year despite early-year anticipation for such legislation, but some stakeholders remain hopeful following November’s midterm elections.

“The best thing that could come out of Washington, D.C., is a long-term federal infrastructure bill,” says Nick Rodgers, executive director of the Kentucky Crushed Stone Association. “This is a bipartisan issue that has potential to put trust back in our government.”

Even without a $500 billion or $1 trillion infrastructure bill, a number of producers performed well in 2018 behind funding provided by state bond measures.

“There was, according to Reuters, $21 billion in bond measures approved in 26 states while only a smaller amount ($3.6 billion) was voted down,” says Robert Murray, chief economist at Dodge Data & Analytics.

According to Murray, aggregate producers may be best positioned among those in the greater construction industry to thrive in 2019.

“Of the various sectors within the overall construction industry, transportation/public works and, specifically, highways and bridges are going to make out relatively better over the next couple of years,” Murray says.

The industry’s strong safety record remains intact, as well. As of press time, 15 people had died in the metal/nonmetal mining sector this year. That’s two more metal/nonmetal fatalities than in 2017.

While 15 fatalities is, of course, 15 too many, that figure is fortunately well below the historical norm, serving yet another reminder that our industry remains one of the safest out there.

Some industry headwinds are swirling, though. As SC-Market Analytics’ David Chereb writes, demand for crushed stone, sand and gravel across the United States remains strong. Demand, however, is not growing as fast as it was over the last few years. The slowing momentum is something to keep an eye on.

Like Chereb, FMI Capital Advisors’ George Reddin and Scott Duncan and Superior Industries’ John Garrison offer positive outlooks for the year ahead. In addition, NSSGA’s Mike Johnson and Brandeis Machinery’s Lee Heffley detail why plenty of work remains in Washington to best position our industry for success.

Still, aggregate producers across the nation are well positioned to seize the opportunities available to them to grow their businesses further in 2019 and into the future.

Sales and pricing

A number of aggregate producers seized opportunities to grow their businesses this year. Based on data P&Q collected in its annual survey for this report, sales were up among 65 percent of producer companies. Sales were up at least 5 percent among 43 percent of producers, and 12 percent of producers report their 2018 aggregate sales jumped more than 10 percent.

Aggregate sales were flat for about one in five producers (21 percent), and they dropped for 14 percent.

Aggregate pricing was another positive development for the industry in 2018. Pricing improved for 71 percent of producers. Most producers raised prices less than 5 percent, but one in four producers (25 percent) managed to adjust pricing upward more than 5 percent.

Pricing was a positive 2018 story for Martin Marietta, one of the nation’s largest aggregate producers. Ward Nye, chairman, president and CEO of the company, expects this trend to carry into the new year.

“We anticipate increased private-sector demand, improving infrastructure construction activity and favorable pricing trends throughout 2019,” Nye says. “We expect our key states to benefit from continued, favorable construction growth due to their attractive economic drivers and population trends.”

Nye isn’t the only one who expects aggregate pricing to continue on its upward path in 2019. About 60 percent of producers anticipate raising prices in 2019, and 30 percent expect pricing to jump by at least 5 percent over 2018 prices.

This approach should have a positive impact on 2019 aggregate sales. The majority of producers P&Q surveyed (76 percent) expect their 2019 sales to be up. Forty-one percent expect sales to be up at least 5 percent over 2018, and 17 percent expect sales to increase by at least 10 percent next year.

Infrastructure funding and safety

Perhaps aggregate producers are so optimistic about 2019 sales and pricing because they feel the federal government is already providing enough funds to support infrastructure projects that drive a healthy demand for the construction materials their company produces.

Forty-three percent of producers – the majority – tells P&Q the federal government is currently providing enough funds to support infrastructure projects. Twenty-seven percent say the federal government needs to do more while 30 percent aren’t sure whether or not enough federal funds are being provided to sustain their businesses.

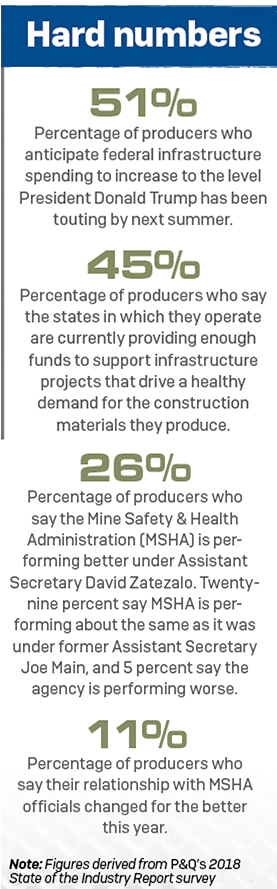

As for the states, the majority of producers (45 percent) feel they are sufficiently supporting infrastructure projects.

On the Mine Safety & Health Administration (MSHA) front, meanwhile, most producers (61 percent) feel the relationship between the agency’s frontline officials and the industry was about the same in 2018 as it was in 2017. But producers are more optimistic with MSHA at the top, where Assistant Secretary David Zatezalo is now a full year into his tenure.

Twenty-six percent of producers tell P&Q that MSHA is performing better under Zatezalo, while 29 percent say the agency is performing about the same under Zatezalo as it was under former Assistant Secretary Joe Main. Only 5 percent say MSHA is performing worse under its new chief, with 39 percent of producers unsure of how to respond to a question pitting Zatezalo versus Main.

“MSHA is trying to be more proactive than reactive to help the mining industry,” says Jim Kingsley, safety and environmental director at V.S. Virkler & Son.

MSHA has work ahead of it, though, “MSHA desperately needs to modernize its available training materials, website, submittal procedures and inspection routines to keep pace with the modern aggregate producer,” says Ross Duff, vice president of Duff Quarry, a producer in Ohio.

What keeps you up at night

Employee retention. Hiring. Safety. Compliance with the Mine Safety & Health Administration (MSHA).

These were the areas that kept aggregate producers up the most at night in 2018. Unfortunately, more producers are worried today than they were a year ago about keeping good employees, finding capable ones from the start and making sure everyone stays safe on the job.

Labor is a very real problem for just about every producer. The most veteran employees are retiring, and with brand-new people making their way into the industry, these dynamics raise concerns about employee safety.

Compliance with MSHA was yet again a top worry. But with a new head at the agency in Assistant Secretary David Zatezalo and an intensified focus on addressing the areas that cause fatalities (i.e., powered haulage accidents), producers are more optimistic about the road ahead with MSHA.