A picture forms about construction materials in the new year

SC Market Analytics expects aggregate demand tied to residential construction to be up in 2021, with demand in nonresidential and nonbuilding anticipated to be down. Photo: P&Q Staff

Aggregate demand will be just fine for the next few years. It will not grow by much until 2023, but considering what we’ve been going through, it will be enough to keep aggregate prices increasing in most markets.

SC Market Analytics looks at both macro and micro (local) events to come up with a national outlook. Therefore, we consider inflation changes, mortgage rates, highway taxes, debt levels, employment changes, state and local budgets, and construction contracts.

When we put it all together, we get many crosscurrents for 2021. If there are no major policy changes, construction activity will decrease by modest amounts – with almost all of it attributed to nonresidential.

Segment by segment

Residential will be strong, as low mortgage rates and high savings rates are enough to overcome higher home prices. Both nonresidential and nonbuilding will be flat to down, but for different reasons.

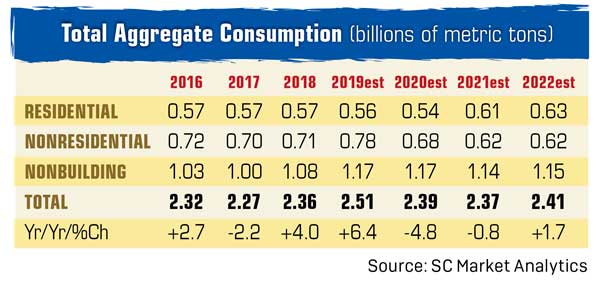

The residential segment will be strong in 2021, with nonbuilding likely ending up weaker than 2020. Click to expand | Source: SC Market Analytics

As we have said before, the structural changes are hitting nonresidential demand the hardest, with little prospect of any real gains for years to come. The retail segment remains in a huge adjustment period due to online shopping gains, and office investment is changing from urban centric to suburban centric due to the virus and social unrest.

Nonbuilding will muddle along as state and local governments strive to rebalance their budgets. We do not expect any major bump in funding from the federal government.

Given the long lead times of most nonbuilding projects, it means 2021 will be weaker than 2020. 2022 will probably be the bottom for this segment.

Other things to consider

We know there is a reasonable likelihood of an infrastructure boost from the federal government, but that is not reflected in our numbers yet. As the dust settles, the numbers will be updated.

Aggregate pricing strength will return by late 2021 in most areas. SC Market Analytics expects aggregate demand tied to residential construction to be up in 2021, with demand in nonresidential and nonbuilding anticipated to be down.

David Chereb, Ph.D., is with SC Market Analytics (SC-MA), which produces customized market forecasts by major segment of construction, from the county level up. Clients use SC-MA market intelligence reports for business planning and acquisition analyses in aggregate, ready-mix concrete and cement. For more information, visit sc-marketanalytics.com